Faced with an aging society and historically low fertility rates, Canada's housing market has a new best friend — the immigrant.

A Bank of Nova Scotia report released Monday projected Canada's average annual rate of population growth will ease to just 0.8 per cent over the coming decade. That compares with 1.3 per cent pace from 1986-1996.

Although home buyers have historically been more influenced by real household income growth and interest rate levels, the slowing population growth comes at a critical point in the cycle. Housing prices have surged in recent years, eroding affordability to a cyclical low, the demand-supply equation is more balanced and pent-up demand has been satisfied, factors that support the notion that the market is levelling off.

Scotiabank senior economist Adrienne Warren, who wrote the real estate trends report, said shifting demographics will play a pivotal role in shaping housing demand, specifically the arrival of newcomers and the increasingly older age of Canadian households.

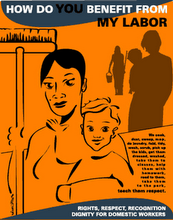

Immigrants, who tend to come to Canada as young adults, start off by renting and gradually transition to buying a home. Although the rate of homeownership among working-age immigrants is essentially on par with that of Canadian-born households, it has dipped slightly in the last decade.

Ms. Warren attributed that slide to weaker earnings growth than native-born Canadians. Many new immigrants are forced to take low-paying jobs because their foreign credentials are not recognized by Canadian companies, something that recent policy initiatives might help address, she said.

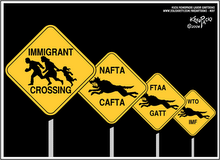

In addition, immigrants tend to settle in big cities, where prices have shot up and homeownership levels are lower. More than three quarters of Canadian immigrants between 1991 and 2001 settled in four urban areas: B.C.'s lower mainland and southern Vancouver Island, the Edmonton-Calgary north-south corridor, the Greater Golden Horseshoe in Southern Ontario, and Montreal and its surrounding area.

Newcomers need to save money and tend to buy homes after they have lived in Canada for at least ten years, Ms. Warren said. In 2001, more than one third of foreign-born residents in Canada's three largest centres had been in the country for ten years or less.

“This suggests a significant pool of potential first-time home buyers ready to enter the Canadian real estate market,” she said. “It also points to the continuing out-performance of major urban areas.”

Canada's housing market has been firing on all cylinders in the last decade, a boom that has sent prices up more than 50 per cent since 1998. Real home prices have jumped for an unprecedented eight consecutive years and are rising still, the longest expansion of the post-war era.

“A period of more moderate activity appears in store over the next several years,” Ms. Warren said, noting that housing starts have fallen in the first part of this year when compared with 2006.

Each of the last three housing cycles — in the 1960s, 1970s and 1980s — were followed by some form of slowdown, typically lasting six years and resulting in a 14 per cent drop in real prices. “However, we feel the current cycle should outperform the ‘average,' given continued buoyant conditions in the Western provinces, and little evidence of significant overbuilding or of widespread speculative buying,” she said.

The changing demographic structure of Canada's population will influence who buys what kind of home and where, according to Ms. Warren's report. The number of Canadians aged 25 to 44 — the group most likely to buy a home — is forecast to increase by just 2 per cent between 2006 and 2016, with all the growth at the youngest end of this cohort.

The baby echo generation, aged 25 to 34, made up of singles or young professional couples, should support continuing moderate demand for entry-level homes and condos, especially in urban centres close to employment opportunities.

The older half of the cohort most likely to buy a home, aged 35-44, is expected to decline in absolute numbers. This group of both first-time home buyers and those looking to trade-up, is more likely to have young families and favour larger suburban homes, a real estate segment that could underperform, Ms. Warren said.

The most powerful demographic segments, Canadians aged 45 to 64, will rise by 15 per cent, while the group over the age of 65 will grow 65 per cent in the next ten years. “While the lifestyles and housing needs of these more mature homeowners vary widely, an aging population should favour new construction over re-sales, lower maintenance options such as condominiums, second homes and vacation properties, and urban areas with greater amenities,” Ms. Warren said.

http://www.theglobeandmail.com/servlet/story/RTGAM.20070604.wscotiahousing0604/BNStory/robNews/